How to spot e-fraud

e-fraud or Electronic Fraud follows many of the basic principles of what we all know as standard fraud, except some of the methods used take advantage of end users’ naivety or lack of experience with computer hardware, software or communications, especially email.

Colloquially known as ‘phishing’ the fraudster will look to use a “bait” – usually a neatly put together email, which looks like an authentic email from a trusted establishment – to fish the customer’s details from them.

A perfect example would be a customer receiving an email from their bank or building society which has been designed with the same graphics and fonts and with messages relating to security or lucrative offers pertaining to the customer’s account. This may inform the customer that an unknown transaction has taken place, or that they need to update or verify their details or that the bank may require their details to send them a gift such as a shopping voucher or e-ticket and then will display a link to a spoof page in the hope that the customer will click through and input their details – possibly their sort code and bank account number, login credentials among other sensitive details – into the webpage which will then be captured by the fraudster’s own servers and software.

Phishing is difficult to identify because the fraudulent emails and websites are often very similar or even identical to legitimate ones and the fraudsters change identities regularly.

Customers need to also be extremely wary of email attachments. Some emails carry attachments that look like innocent documents, but contain various malware and spyware – software designed to track information directly from your own PC.

Genuine communication from banks, building societies or other financial institutions will not ask you to provide such sensitive data in their communications, nor would they send you attachments out of the blue, unless it is relating directly to a product or query you have requested.

Here are 3 simple rules customers can adopt, the same rules that would apply to the real world, to prevent becoming a victim of such online crime:

1. If you are suspicious, do not open!

This rule should be absolutely adopted before any other and would just about cover prevention of any scam or fraud. If you do not open the email, then you are in no real danger of creating issues. Although we would never advise to open a suspicious email, if you do so, it likely will not be harmful providing you do not go on to click through any links or open attachments within the email.

Real world scenario: Would you open your front door to a suspicious looking person who knocks uninvited? If you did happen to let them in, would you then proceed to give him your bank details if he asks?

2. If you suspect a suspicious email or link, then close the email immediately and either give your bank a call, or open a NEW internet window and log in separately.

Banks will also send you genuine emails with links to the site, but not ask you explicitly for your details. Again, if unsure, please exercise caution and just give your bank a call.

Real world scenario: Someone calls you from your bank and wants to discuss your account. Either get the person on the other end of the phon to confirm your details first, or hang up and find your bank’s genuine number from their website to call them directly. Go through full security measures on the call and they can then discuss the matter, if it was indeed a genuine call. If you find the previous call was unknown to your bank, then report the phone number.

3. Never download and open any software or programs from sites or that you cannot be sure are trustworthy.

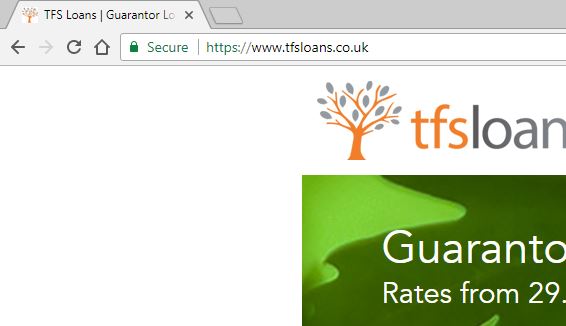

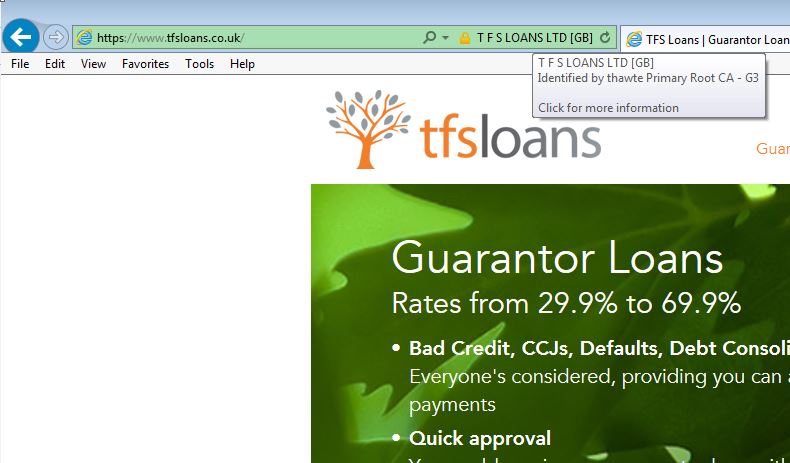

How do you know a site is trustworthy? Usually, reputable companies have a security certificate installed on to their website which shows a level of security is in place (Please see images of our own security below), but do still exercise caution with your information and, as mentioned previous, never open unknown attachments from emails you were not expecting.

Real life scenario: Would you take a bag through security at an airport if a stranger assured you that the bag contained no dangerous items or substances?

At TFS Loans, we have strict security measures in place to ensure that all customer details are kept secure at all times. If ever you have any suspicions as a TFS Customer, please call us immediately on 0203 476 4170

Please take a look at the below images of security certificates at our own site here at TFS Loans. The first image is how to spot a secure site on Chrome, the second image is the same on Internet Explorer (you can hover over the security certificate on the actual site to see more details).

Security Certificate example on Chrome:

Security Certificate example on Internet Explorer:

TFS Loans are specialist Guarantor Loan lenders. We offer Guarantor Loans from £1,000 – £15,000 for a range of purposes including large purchases like cars, home improvements, weddings and other events, debt consolidation and for start-up/small businesses..

44.9% APR Representative

0203 476 4170

0203 476 4170